Rachael Maniord

Product Management & Design Leader

The problem

People struggle to manage money.

Over 50% of Australian people aged 18-35 live pay-check to pay-check.

They want/need tools & support to enable them to have:

Better insight into their future financial outcomes.

A deep understanding of current financial habits - specifically spending and how these behaviours are likely to affect their future.

Immediately identify all current financial commitments (bills and loans) to identify what needs to be paid when and their ability to meet these commitments.

Set a plan for upcoming weeks to identify how to live within current constraints and automatically track progress against this plan on a daily basis.

Why budgeting doesn’t work

Traditional budgeting tools look backwards

While this can be useful for tracking purposes to see where you ended up last week, it doesn’t help solve immediate cash flow pitfalls. You’ve already spent that money and maybe there are some unforeseen expenses coming up in the future. *Queue ominous music.

Manual data entry… ain’t nobody got time for that

People don’t want to manually enter income and other data themselves. Most people also severely underestimate how much they actually spend, rendering their budget pretty inaccurate or unattainable for what they actually want.

Set and forget isn’t always best

Most people that set up budgets don’t stick to them for long. Maybe it’s too unrealistic or too tedious to keep up. It may also be the general fact that people do not want their lifestyle spending choices constrained by traditional views on money, “spend less and save”.

A gap in the market

Millennials love to travel, have big nights out, buy stuff they don’t necessarily need and eat out… a lot. But, they still gotta pay the rent, buy groceries and pay the bills. They want transparency, flexibility, and choice. This can only be achieved by a holistic solution with cash flow transparency and payment flexibility across pay-cycles.

Traditional banks are not meeting these needs and other fintechs in the market are providing commoditised product ‘wedges’, not a holistic solution.

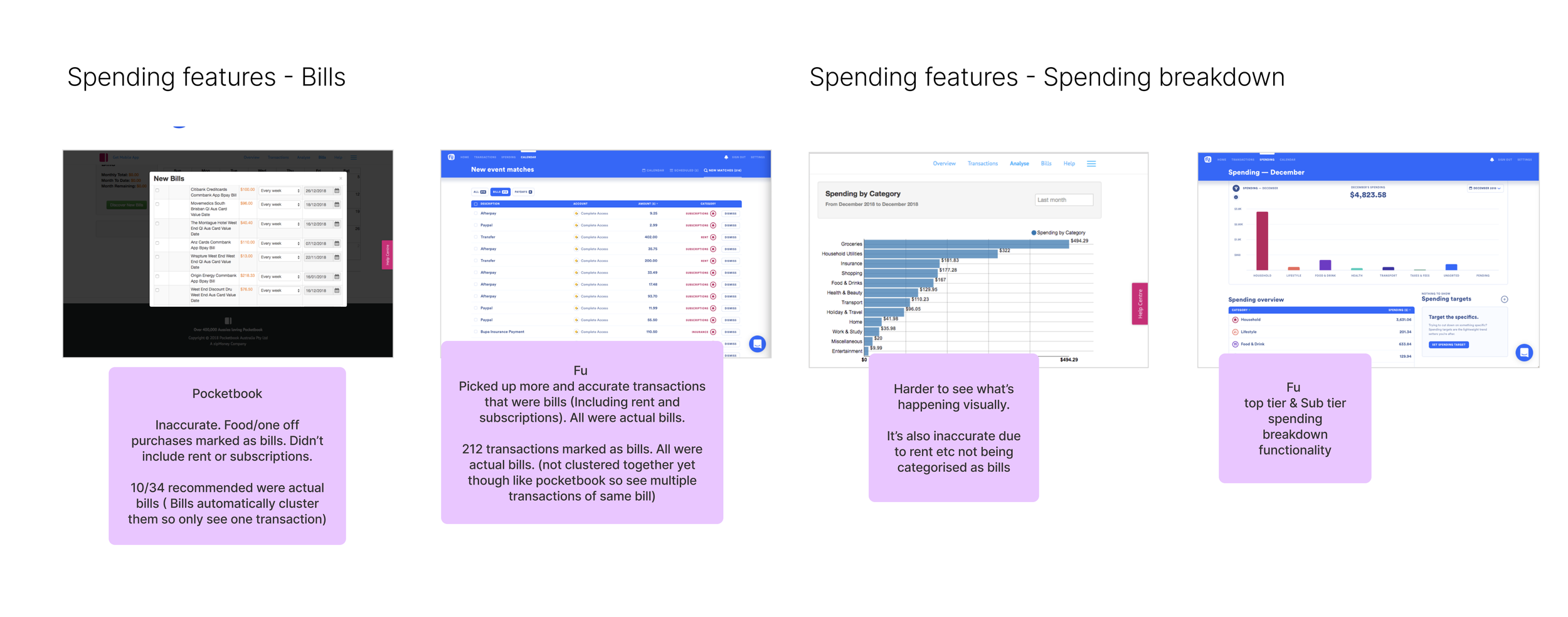

Competitor analysis

Fu wants to redefine the concept of budgeting

A real time, money management platform tracking and forecasting your income, spending and available cash flow (utilising data & analytics).

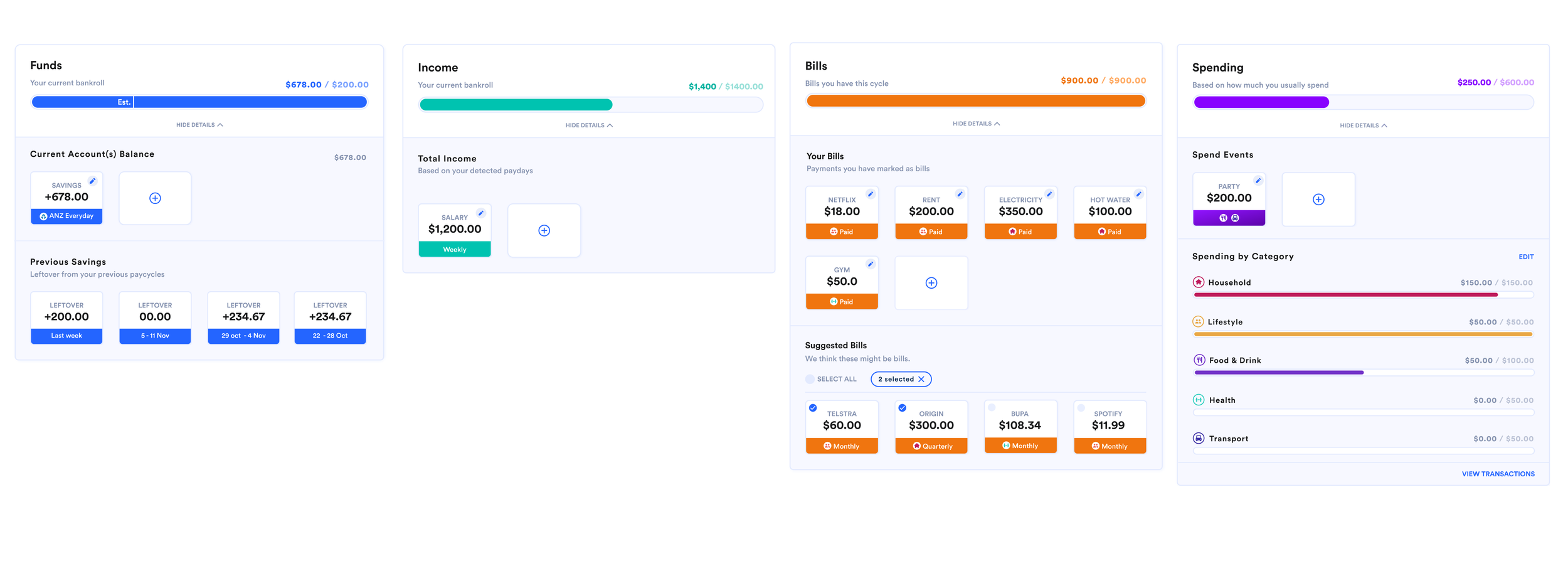

The Platform - Visualising the data

Prior to me starting work at Fu the data and engineering team had spent a year finessing the Fu backend. This consists building a system to programatically take transactional data and categorise transactions, detect and create bill and payday events (calendar based) as well as calculating a users average discretionary spending per pay-cycle by averaging 3 months of spending behaviour. This all drives the algorithm to determine how much money a user is going to have at the end of each pay-cylcle going forward “Leftovers”.

Fu had also built a basic web product for transactions and some basic ‘budgeting’ features. (Ux/UI done by Ben Wilkinson, my predecessor)

My first cab of the rank as the newest member of the Fu Crew was to design a dashboard to visualise the forward looking cash flow feature we call Flow. Firstly starting with web, adding to what had already been built, and then to build a similar experience for a new Fu App.

Creating a Feature list based on our platform:

Overall financial position dashboard - current, past & future by pay-cycle

Positive & negative positioning - Actions to be added later

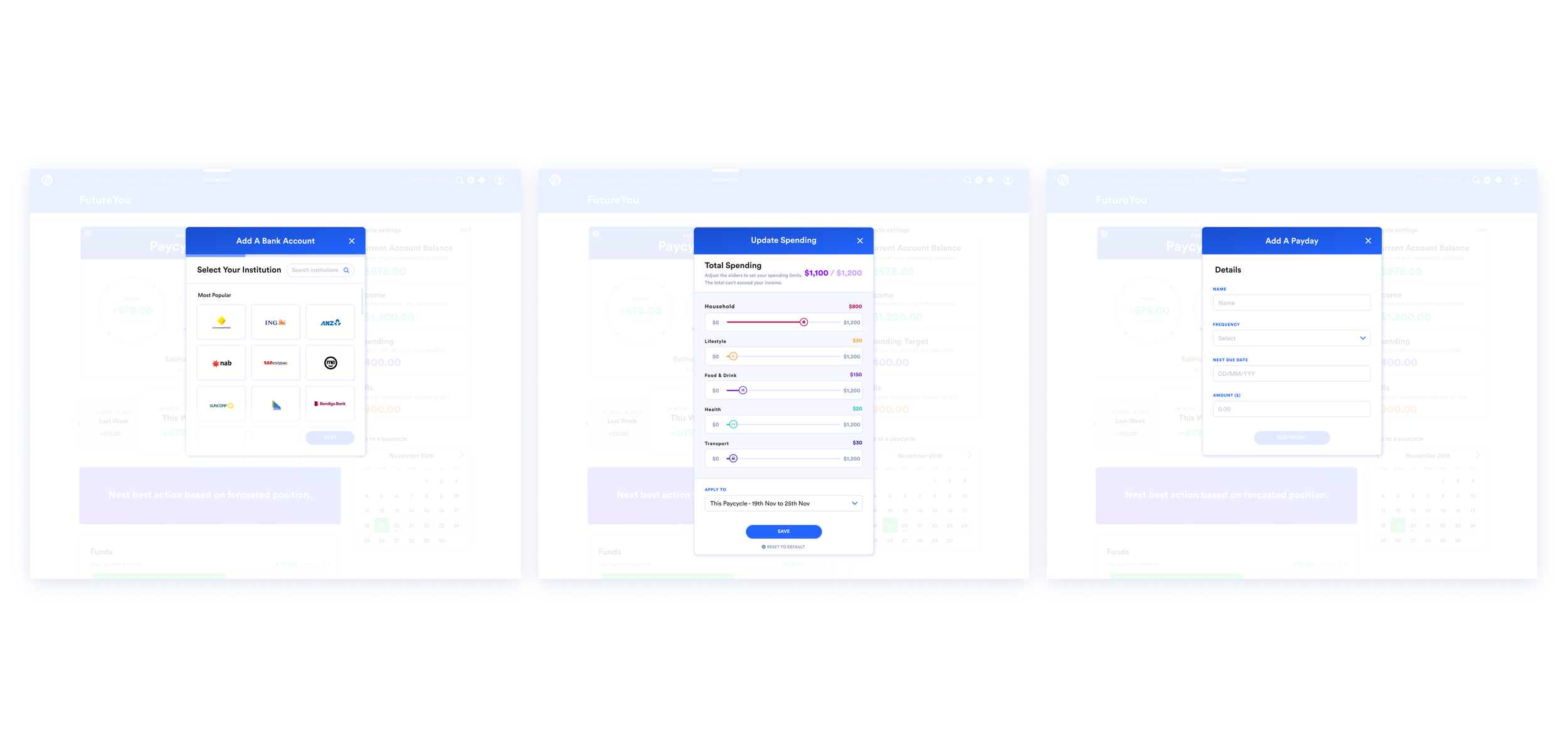

Settings

Include/exclude credit balances i.e. personal loans

Toggle on and off banks

Set pay-cycle frequency (i.e. weekly, monthly or fortnightly)

Leftovers

Estimated cash leftover at the end of each cycle

Previous cycles results

Warning if predicted shortfall in future week ( 0 or negative balance)

Bills & Income

Calendar events

Add new/edit event

Suggest new event if data detects new transaction clusters

Total $ amounts estimated per cycle

Notification if overdue

View transactions linked to these events

Spending

Spending by Parent & sub-categories

Estimated spending predictions per cycle

Notifications of overspend - spending more than usual on a category or predicted overspend

Editing spending calculations

view transactions linked to spending - all, category & sub-category

Fu Flow

The following is the result of a few design iterations based on business feedback & testing prototypes with stakeholders and the development team.

It was a business decision at the time to skip wire framing and go straight to design phase given we had some base-line from branding & existing web product. This was largely due to being a very early stage start up and the need for speed was critical. Speed to market & also for capitol raising/investor purposes.

Testing and learning in a live environment with Fu Users

Usability testing is tricky in the finance space. Here’s a few reasons why:

Money is extremely personal, in a test environment this only amplifies the general anxiety some people feel

People don’t want to reveal their banking transactions for recordings etc., again, it’s too personal

The data needs to come from the real world. Although some of the data aggregators Fu uses provide dummy data, it is not accurate or realistic enough to provide a real world experience.

Time has not allowed us to create our own dummy data to date

Given the above, user testing encompassed delivery of a consumer facing beta website to gain customer feedback into the accuracy of the data and services provided in a live environment. After this a few things were iterated upon such as language and then implemented in designs for the Fu App.

Some Key Takeaways which get addressed in future iterations of the Fu App ( Flow & Future u case studies)

Bank linking and scraping the transactions takes a long time… too long - at this point we were also a few years out from Open Banking as well, so a solution needed to be thought of

Users still had some queries about the security of their data & banking information

The concept of funds (last cycles leftover & income, less money spent & bills paid) was confusing for some

The ‘doughnuts’ are not ideal on small phones.

Users surprisingly didn’t know that their online banking credentials are not Account Numbers or BSBs